Decoding AARP Supplement Costs A Guide to Medicare Supplement Insurance

Are you approaching retirement or already enjoying your golden years? Healthcare costs can be a significant concern, and understanding your options is crucial. For many, AARP-endorsed Medicare Supplement Insurance plans (also known as Medigap) offer a way to manage those costs. But how much do these plans actually cost? This guide dives deep into the world of AARP supplement pricing, helping you navigate the ins and outs of these important healthcare options.

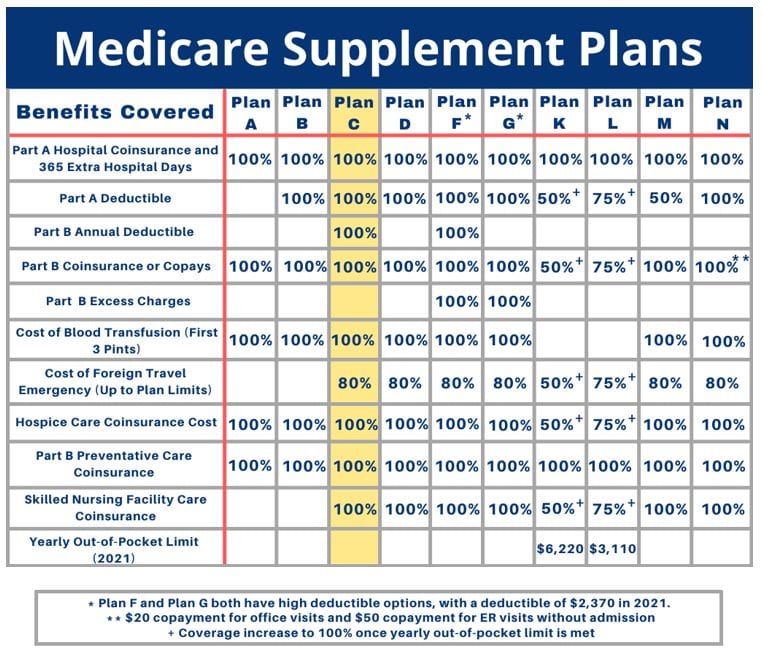

Figuring out the price tag of an AARP Medicare Supplement plan isn’t a one-size-fits-all situation. Several factors influence the final cost. These include your age, location, the specific plan you choose (Plan A, Plan G, Plan N, etc.), and even the insurance company offering the AARP-branded plan. Understanding these factors is the first step toward making an informed decision.

AARP doesn't actually directly sell insurance. They endorse plans offered by UnitedHealthcare Insurance Company. This collaboration leverages AARP's strong reputation and provides members access to a variety of plans. The history of these plans is tied to the evolution of Medicare itself, aiming to fill in the gaps left by original Medicare coverage.

Why is understanding AARP supplement insurance costs so important? Simply put, it’s about peace of mind. Knowing what to expect financially allows you to budget effectively and avoid unexpected healthcare expenses. These plans offer a safety net, helping to cover costs like copayments, coinsurance, and deductibles that original Medicare doesn't fully cover.

Let’s break down AARP supplement plan costs further. The various plans (designated by letters like A, G, and N) offer different levels of coverage, and therefore come with different price tags. Plan F, for example (no longer available for new Medicare beneficiaries), used to offer the most comprehensive coverage but typically came with a higher premium. Plan G is now the most comprehensive option available to newly eligible Medicare beneficiaries. Plan N offers a middle ground, covering many costs but potentially leaving you with some copays. Comparing these plans is vital to finding the balance between coverage and affordability.

Navigating AARP plans can be easier with online resources. UnitedHealthcare's website allows you to get quotes based on your specific location and needs. Independent insurance brokers can also provide valuable insights and comparisons across multiple carriers.

Advantages and Disadvantages of AARP Supplement Plans

| Advantages | Disadvantages |

|---|---|

| Predictable costs | Monthly premiums |

| Gap coverage for Medicare expenses | Cost can vary depending on plan and location |

| Network flexibility (generally accepted anywhere Medicare is) | Doesn't cover everything (e.g., long-term care, dental, vision) |

Frequently Asked Questions (FAQs):

1. How can I get a personalized AARP supplement cost estimate? Contact UnitedHealthcare or a licensed insurance agent for a quote tailored to your situation.

2. What factors affect the cost of AARP plans? Age, location, plan type, and underlying health conditions (in some cases) can influence premiums.

3. Does AARP offer different plan options? Yes, various plans (like G, N) provide different levels of coverage and have varying costs.

4. Are there any discounts available on AARP plans? Some plans may offer household discounts if you and your spouse both enroll.

5. Can I change my AARP supplement plan later? You can typically switch plans during the Medicare open enrollment period or under certain qualifying life events.

6. What’s the difference between Medicare Advantage and AARP supplements? Supplements work with original Medicare, while Advantage plans are an alternative to it.

7. Where can I find more information about AARP supplement plans? Visit the UnitedHealthcare website or the official Medicare.gov site.

8. How do I enroll in an AARP supplement plan? Contact UnitedHealthcare directly or work with a licensed insurance broker.

Making informed decisions about your healthcare coverage is essential for your well-being. Understanding the factors that determine AARP supplement insurance costs is a significant step towards securing your financial future. By researching plan options, comparing prices, and considering your individual needs, you can confidently choose a plan that provides the coverage you need at a price you can afford. Consider talking to a financial advisor or insurance broker for personalized guidance.

Decoding the toyota rav4 xle premium price is it worth the investment

Visualizing the invisible exploring the potential of sky and tree cloud chambers

Sherwin williams ceiling paint white the ultimate guide