Decoding Medicare Plan F: A Smart Comparison Guide for BCBS Coverage

Choosing the right Medicare plan is a big decision, and with so many options available, it can feel overwhelming. For those considering Plan F, often known for its comprehensive coverage, understanding the nuances of different offerings, especially from a major provider like Blue Cross Blue Shield (BCBS), is crucial. This guide aims to demystify BCBS Plan F Medicare comparison, offering you a clear roadmap to make an informed choice.

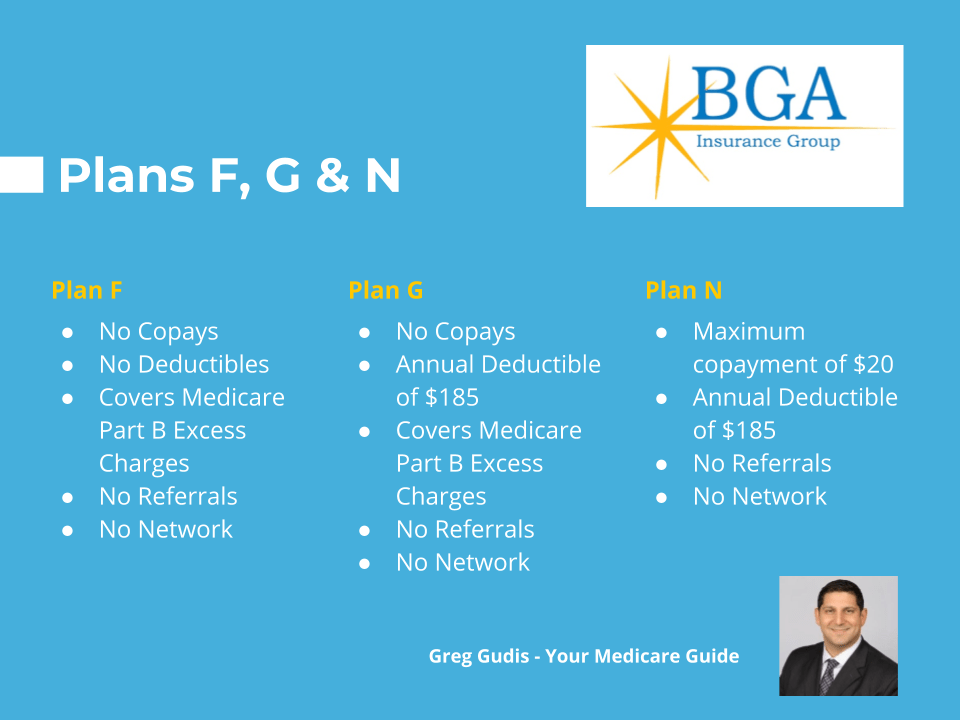

So, what's the big deal with Plan F? It used to be the gold standard, covering virtually all Medicare-approved expenses. However, changes in Medicare regulations have impacted Plan F availability for new enrollees. While those who already have it can keep it, comparing available BCBS Medicare supplement plans like Plan G or Plan N is now essential for individuals newly eligible for Medicare. This comparison involves scrutinizing premiums, deductibles, and coverage gaps to align your needs with the most suitable plan.

Historically, Plan F offered peace of mind with its comprehensive coverage. It eliminated out-of-pocket expenses, making budgeting for healthcare predictable. Now, comparing BCBS Medicare Supplement plans requires understanding how plans like G and N differ from F and how those differences impact your overall healthcare costs. Evaluating available BCBS Medicare options means considering factors beyond just premium costs.

The key to navigating this complexity is a thorough BCBS Plan F Medicare comparison (or a comparison of other plans if you're a new enrollee). This involves understanding your personal healthcare needs and how they intersect with the coverage provided by each plan. Factors to consider include the frequency of doctor visits, anticipated hospital stays, prescription drug needs, and your overall budget for healthcare expenses.

Comparing BCBS Medicare supplement plans requires digging into the specifics. You’ll want to look at the out-of-pocket costs associated with each plan. For example, Plan G covers almost everything Plan F did, except for the Part B deductible. Plan N requires copays for some doctor visits and emergency room visits. By carefully considering these details, you can make an informed choice that aligns with your individual health profile and financial situation.

BCBS Plan F Medicare comparison has become more complex due to the changes in Medicare rules. Understanding which plans are still available and comparing similar plans is crucial.

For new Medicare beneficiaries, comparing plans like G, N, and other available Medicare Supplement plans offered by BCBS is essential to find the best fit.

One benefit of comparing plans is finding the right balance between coverage and cost. Another benefit is understanding the out-of-pocket expenses associated with each plan. Finally, comparing plans empowers you to make an informed decision tailored to your health needs.

Advantages and Disadvantages of Comparing Medicare Supplement Plans

| Advantages | Disadvantages |

|---|---|

| Informed Decision Making | Time Consuming |

| Cost Savings | Information Overload |

| Personalized Coverage | Potential for Confusion |

FAQs:

1. What is the difference between Medicare Supplement Plan F and Plan G? Plan G covers almost everything Plan F does except the Part B deductible.

2. Can I still enroll in Plan F? Not if you are newly eligible for Medicare.

3. What is the Part B deductible? The annual amount you pay for Part B covered services before Medicare starts to pay.

4. What other Medicare Supplement plans are available? Plans G, N, and others are available depending on your location.

5. How do I compare BCBS Medicare Supplement plans? Research BCBS’s website or contact a licensed insurance agent.

6. What should I consider when comparing plans? Your healthcare needs, budget, and the plan’s coverage.

7. Are premiums the only cost to consider? No, consider deductibles, copays, and coinsurance.

8. How often can I change my Medicare Supplement plan? Typically, once a year during the open enrollment period.

Tip: Work with a licensed insurance agent specializing in Medicare to navigate the complexities of plan comparisons.

Making a well-informed decision about your Medicare coverage is vital for your health and financial well-being. While Plan F offered comprehensive coverage and was once a popular choice, understanding its current availability and comparing alternative BCBS Medicare Supplement plans like G and N is now more important than ever. By carefully weighing your healthcare needs, budget, and the specifics of each plan's coverage, you can select the best option. Remember that resources like the Medicare.gov website and licensed insurance agents specializing in Medicare can offer valuable assistance in navigating this complex landscape. Don’t hesitate to seek professional guidance to ensure you secure the coverage that best meets your needs. Taking the time to compare plans and understand their implications will empower you to make a confident choice and ensure you have the appropriate coverage for your healthcare journey ahead. This thorough comparison not only helps you manage your healthcare expenses effectively but also provides peace of mind knowing you have the right support in place.

Revolutionize your bathroom with a walk in shower prefab base

Unlocking the power of birthday wishes for kids

Cracking the code the allure of enthusiastic crossword clues