Navigating Medicare Part B Monthly Premiums

Healthcare, a cornerstone of modern life, often intertwines with complex financial considerations. For those eligible for Medicare, understanding the nuances of Part B premiums is crucial for sound financial planning. This exploration delves into the fabric of Medicare Part B’s monthly costs, unraveling its threads to provide a clearer picture.

Navigating the landscape of Medicare Part B monthly premiums can feel like traversing a new city. Where do you begin? What landmarks should you look for? The Medicare Part B standard monthly premium isn't a static figure; it's influenced by various factors, including income. Understanding these influences is the first step in effectively managing your healthcare budget.

The monthly premium for Medicare Part B represents an investment in your health, providing access to crucial medical services like doctor visits, outpatient care, and preventive services. This investment, however, requires careful consideration. What factors influence the Part B premium amount? Income plays a significant role, and understanding the income-related monthly adjustment amount (IRMAA) is essential for accurate budgeting.

Medicare Part B premiums are rooted in the Social Security Amendments of 1965, which established Medicare itself. Over time, these premiums have evolved, reflecting changes in healthcare costs and utilization. The historical context provides a valuable perspective on the current state of Part B premium calculations.

Why is understanding your Medicare Part B premium so important? Beyond simply budgeting, understanding its intricacies can empower you to make informed decisions about your healthcare coverage. Knowing how the premium is determined, what it covers, and how it interacts with other aspects of Medicare can provide significant peace of mind.

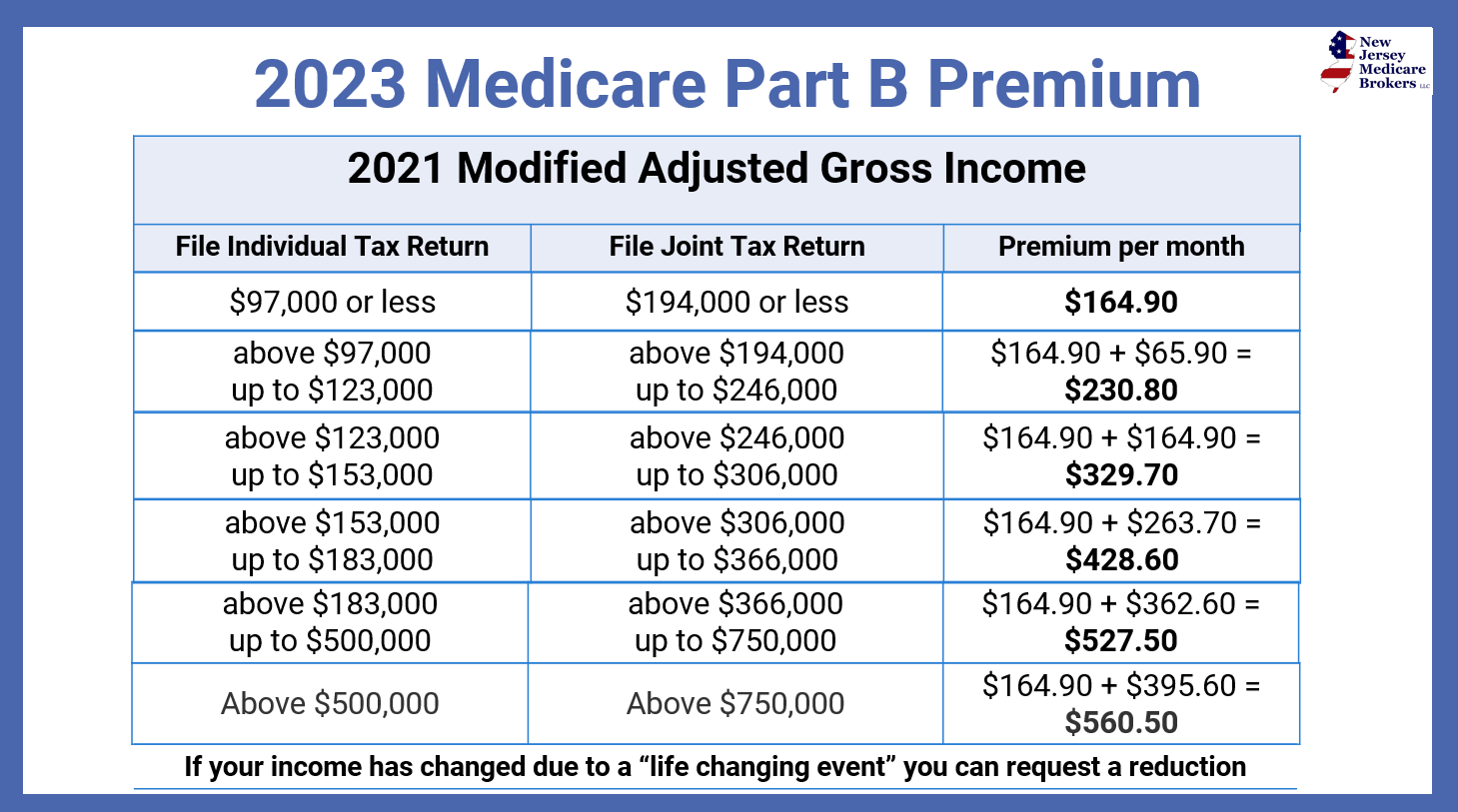

The standard Medicare Part B premium is set annually. However, individuals with higher incomes may pay a higher premium due to the IRMAA. This additional amount is based on your modified adjusted gross income (MAGI) as reported to the IRS. There are several IRMAA tiers, each corresponding to a specific income range.

For example, a single beneficiary with a MAGI below a certain threshold will pay the standard Part B premium. However, if their income exceeds that threshold, they will pay a higher premium based on the corresponding IRMAA tier. These tiers ensure that those with higher incomes contribute a larger share towards the cost of Medicare Part B.

One benefit of understanding your Medicare Part B premium is the ability to accurately budget for healthcare expenses. This allows for better financial planning and avoids unexpected costs. Another benefit is the potential to identify opportunities for savings. For instance, exploring options like Medicare Advantage (Part C) plans can sometimes offer lower out-of-pocket costs for certain services.

A proactive approach to understanding your Medicare Part B premiums involves checking your income annually and understanding the associated IRMAA tier. Staying informed about changes to Medicare regulations and premium amounts is also crucial for maintaining accurate budgeting and healthcare planning.

Advantages and Disadvantages of Medicare Part B Premiums

| Advantages | Disadvantages |

|---|---|

| Access to essential medical services | Can be a significant expense, especially for those with higher incomes |

| Predictable monthly cost (within your income bracket) | Subject to change annually based on various factors |

A key takeaway is the importance of proactively engaging with your Medicare Part B premiums. Understanding the cost, the factors influencing it, and the resources available can empower you to navigate the complexities of healthcare financing effectively. This knowledge translates to better budgeting, informed decision-making, and ultimately, greater peace of mind regarding your health and financial well-being.

Frequently Asked Questions:

1. How is the standard Part B premium determined? (Answer: Annually by the Centers for Medicare & Medicaid Services based on various factors including healthcare costs.)

2. What is IRMAA? (Answer: Income-Related Monthly Adjustment Amount - an additional premium for higher-income beneficiaries.)

3. How do I find my MAGI? (Answer: From your IRS tax return.)

4. What services does Part B cover? (Answer: Doctor visits, outpatient care, preventive services, and some medical equipment.)

5. How can I appeal my IRMAA determination? (Answer: Contact Social Security Administration.)

6. What is the difference between Medicare Part A and Part B? (Answer: Part A covers hospital care, Part B covers medical services.)

7. Are Part B premiums tax deductible? (Answer: Potentially, depending on your specific circumstances; consult a tax advisor.)

8. How do I enroll in Medicare Part B? (Answer: Through the Social Security Administration.)

Tip: Consider setting up automatic payments for your Part B premiums to avoid late fees.

In conclusion, understanding the landscape of Medicare Part B monthly premiums is akin to mastering a new skill. It empowers you to take control of your healthcare finances, facilitating better budgeting, informed decision-making, and reduced financial stress. By understanding the factors influencing the premium cost, you can approach healthcare planning with clarity and confidence. This proactive engagement with your Medicare benefits is an investment not only in your health but also in your overall financial well-being. It’s essential to stay informed about potential changes in premium amounts and utilize available resources to navigate the intricacies of Medicare effectively. Take the time to explore the details of your Part B premiums and gain the peace of mind that comes with informed financial planning. By engaging with the information available and understanding your individual circumstances, you can confidently navigate the complexities of Medicare and ensure access to the healthcare services you need. Reach out to Medicare.gov or your local Social Security office for personalized assistance.

Taurus man capricorn woman a cosmic power couple

The isle server costs deconstructed

The unsettling allure of dark cute anime