Navigating Ocean City NJ Property Taxes Online

In the sun-drenched coastal paradise of Ocean City, New Jersey, property ownership comes with its own set of financial responsibilities, chief among them being property taxes. But navigating this fiscal landscape doesn't have to be a daunting task. The digital age has ushered in a new era of convenience, offering online access to a wealth of information and resources related to Ocean City NJ property taxes.

Gone are the days of painstaking paper trails and in-person office visits. Ocean City, recognizing the need for a streamlined system, has embraced online platforms to make managing property taxes more efficient and accessible. Whether you're a seasoned homeowner, a prospective buyer, or simply curious about the local tax structure, accessing Ocean City NJ property tax information online is a game-changer.

The evolution of Ocean City NJ property taxes from traditional methods to the online sphere reflects a broader trend in municipal governance. As technology continues to evolve, local governments are increasingly leveraging digital tools to enhance transparency, improve citizen engagement, and simplify complex administrative processes. This shift has significantly impacted how residents interact with their local government, including how they manage their property taxes.

Understanding Ocean City NJ property taxes is paramount for anyone invested in the local real estate market. These taxes are a crucial source of funding for essential municipal services, including schools, public safety, and infrastructure maintenance. By gaining insight into the intricacies of the online property tax system, residents can ensure timely payments, avoid penalties, and actively participate in the financial well-being of their community.

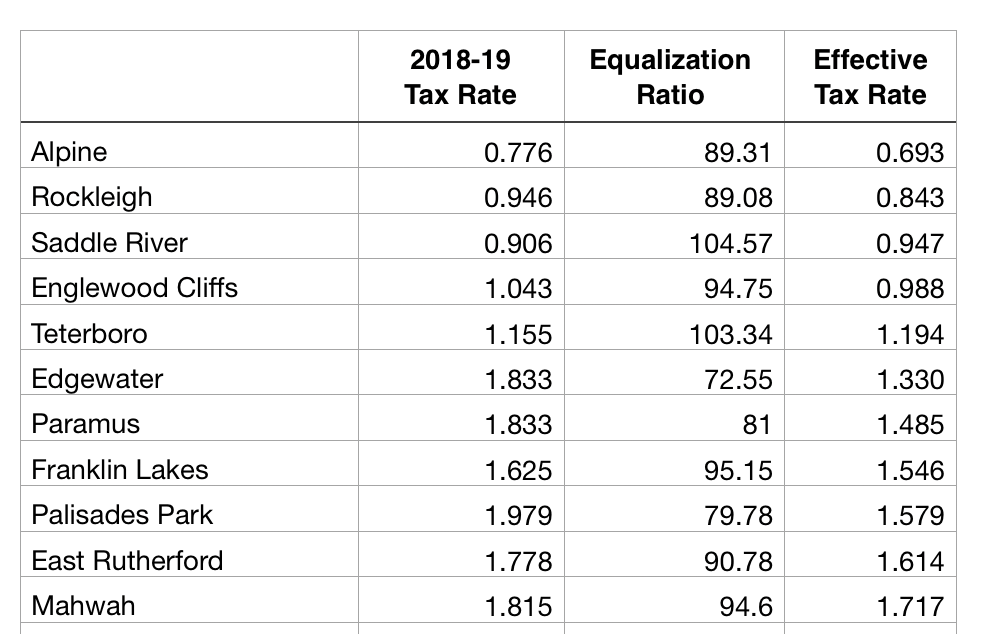

One of the key issues surrounding Ocean City NJ property taxes is ensuring equitable assessments. Property values fluctuate, and maintaining accurate assessments is essential for a fair and balanced tax system. The online platform allows homeowners to access their property assessments and understand the factors influencing their tax liability. This transparency empowers residents to challenge assessments if they believe they are inaccurate, promoting accountability and fairness within the system.

The City of Ocean City provides an online portal for accessing property tax information. This portal allows residents to view their current tax bill, make payments online, and access historical tax data. Some third-party websites also offer aggregated property tax information for Ocean City.

Benefits of accessing Ocean City, NJ property taxes online include 24/7 accessibility, eliminating the need for in-person visits or phone calls. Online payment options provide flexibility and convenience, while readily available online resources empower residents to understand the tax system and manage their finances effectively.

Advantages and Disadvantages of Online Property Tax Access

| Advantages | Disadvantages |

|---|---|

| 24/7 Access | Requires internet access |

| Convenient Payment Options | Potential security concerns |

| Access to Historical Data | Technical difficulties may arise |

Best Practices for Utilizing Ocean City, NJ Property Tax Resources Online:

1. Regularly check your property assessment online.

2. Sign up for email or text alerts for tax due dates.

3. Utilize online payment options for convenient and timely payments.

4. Explore available online resources to understand property tax calculations and exemptions.

5. Keep your contact information updated on the online portal.

Frequently Asked Questions about Ocean City NJ Property Taxes Online:

1. How can I access my Ocean City property tax bill online? (Answer: Through the city's official website or third-party platforms)

2. What payment methods are accepted online? (Answer: Typically credit/debit cards and electronic checks)

3. Can I set up automatic payments? (Answer: Many municipalities offer this option)

4. How do I appeal my property assessment? (Answer: Information and forms are usually available online)

5. What are the penalties for late payment? (Answer: Varies depending on local regulations)

6. Where can I find information on property tax exemptions? (Answer: Check the city's official website)

7. Who can I contact for assistance with online property tax access? (Answer: Contact the Ocean City Tax Assessor's office)

8. How often are property assessments updated? (Answer: Typically annually or as needed based on market fluctuations)

Tips and Tricks: Bookmark the official Ocean City property tax portal for easy access. Set reminders for tax deadlines to avoid late payment penalties. Explore available online calculators to estimate your property tax liability.

In conclusion, the online accessibility of Ocean City NJ property tax information represents a significant stride towards a more efficient and user-friendly system. By embracing these digital resources, homeowners and investors can effectively manage their property taxes, understand their financial obligations, and contribute to the vibrancy of the Ocean City community. Leveraging the online platform empowers residents to stay informed, make timely payments, and engage with the local tax system in a more proactive and informed manner. Take advantage of the available online resources to navigate the complexities of Ocean City NJ property taxes with confidence and ease. It is crucial to stay informed and take an active role in understanding your tax responsibilities, which directly contribute to the functioning and prosperity of this beautiful coastal community. Start exploring the digital realm of Ocean City property taxes today.

Graffiti lettering design from street art to creative expression

Wisconsins finest lake towns discover serenity

Cumberland county nc arrests making headlines