Navigating Wells Fargo Payments Automated Assistance

In today's fast-paced world, managing finances efficiently is crucial. Many individuals and businesses rely on automated systems for bill payments and account management. This raises questions about how to effectively use these services, particularly when it comes to navigating automated phone systems for financial institutions like Wells Fargo.

Understanding the nuances of automated phone systems can be key to seamless financial management. Wells Fargo, like many large banks, offers automated phone services for various banking tasks. While these systems offer convenience, they can sometimes be challenging to navigate. This article aims to provide a comprehensive overview of managing Wells Fargo accounts through automated phone systems.

Automated phone systems have become increasingly sophisticated, offering a wide range of services. From making payments and checking balances to transferring funds and updating account information, these systems can handle many tasks. However, understanding the specific prompts and options within each system is essential for successful navigation. This is particularly true for Wells Fargo's automated phone system, which offers a robust set of features.

Navigating an automated phone system effectively requires understanding the available options and prompts. Knowing how to respond to these prompts accurately ensures a smoother experience and allows you to access the specific services you need. Whether you're making a payment, checking your balance, or accessing other account information, a clear understanding of the system's structure is essential.

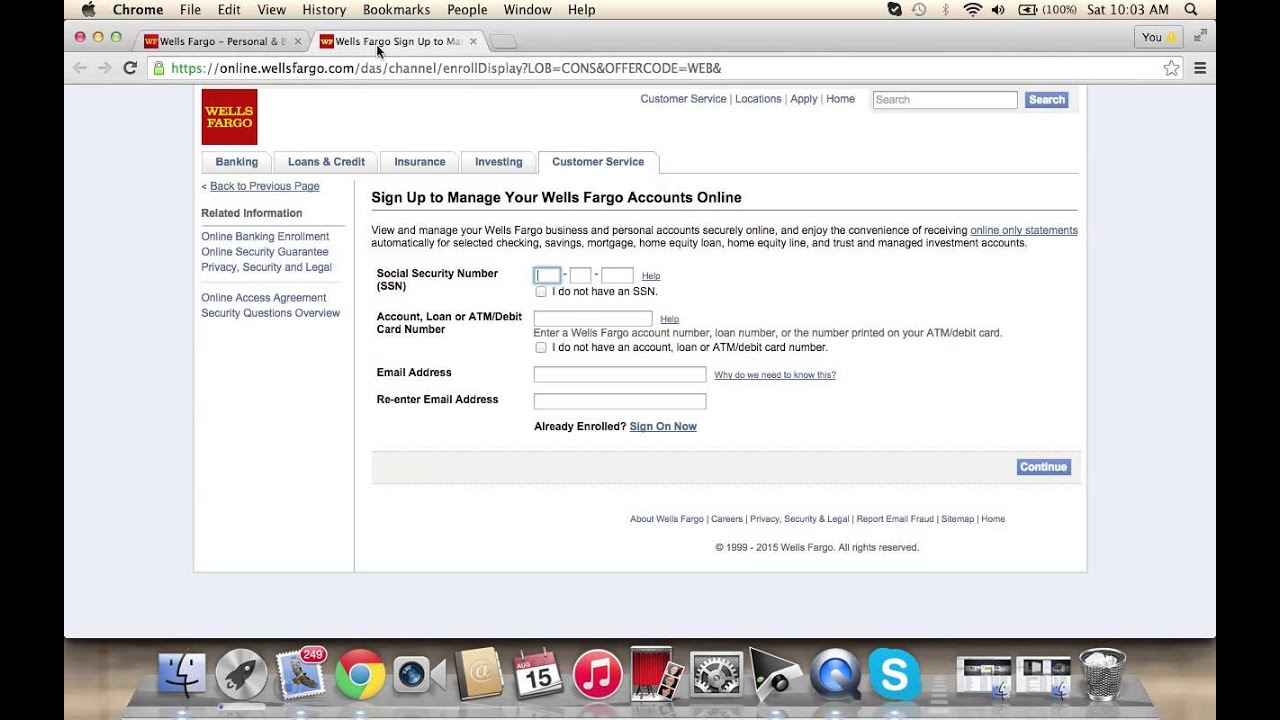

While many customers access their accounts online or via mobile apps, automated phone systems continue to play a vital role, especially for those who prefer verbal communication or have limited internet access. These systems offer a critical alternative for managing accounts and accessing important financial information. Understanding the ins and outs of these systems can empower you to manage your Wells Fargo accounts effectively.

Wells Fargo has offered automated phone banking services for decades, evolving with technological advancements. Originally, these systems were limited to basic balance inquiries and transfers. Today, they offer a wider range of functionalities.

One key benefit of using the Wells Fargo automated phone system is 24/7 account access. You can manage your finances anytime, anywhere. Another advantage is the speed and efficiency of transactions. Automated systems often process requests faster than human operators.

Finally, automated systems can provide enhanced security through voice authentication and other security measures, protecting your financial information from unauthorized access.

If you need to make a payment, you can typically navigate the system by selecting the "Payments" option, followed by prompts for your account number and payment details.

Advantages and Disadvantages of Automated Phone Systems

| Advantages | Disadvantages |

|---|---|

| 24/7 Access | Potential for Navigation Challenges |

| Speed and Efficiency | Limited Personal Interaction |

| Enhanced Security Features | Dependence on Clear Voice Prompts |

Best Practice: Speak clearly and concisely when interacting with the automated system.

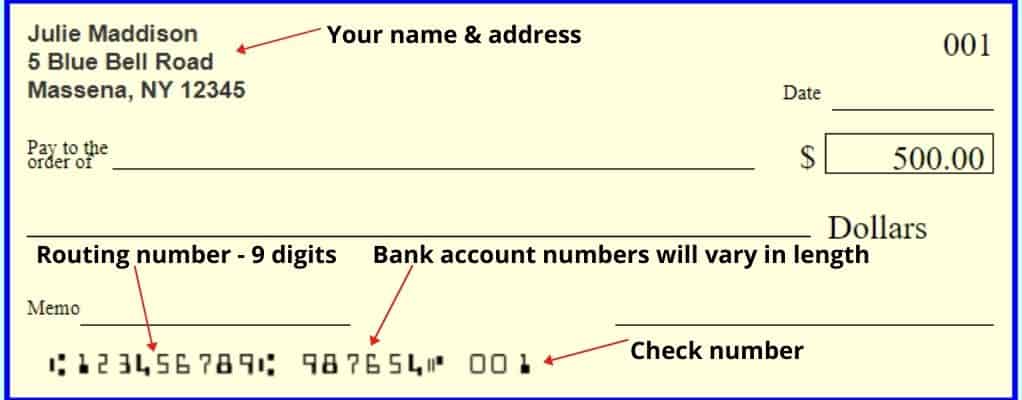

Best Practice: Have your account information readily available.

Best Practice: Listen carefully to the prompts and options.

Best Practice: Use the automated system during off-peak hours for potentially faster service.

Best Practice: If you encounter difficulties, utilize the option to speak to a live representative.

Frequently Asked Questions:

Q: What can I do using the Wells Fargo automated phone system? A: You can typically check balances, make payments, transfer funds, and access account information.

Q: Is the automated system available 24/7? A: Yes, generally the system is accessible around the clock.

Q: What should I do if I have trouble navigating the system? A: You can choose the option to speak with a Wells Fargo representative.

Q: Is the automated system secure? A: Yes, security measures are in place to protect your information.

Q: Can I access all my accounts through the automated system? A: Generally, yes, but specific access may depend on your account types.

Q: What if I forget my account number? A: You might need to contact customer service for assistance.

Q: Can I change my address through the automated system? A: Some updates might be possible, but complex changes often require contacting customer support.

Q: Can I set up recurring payments through the automated system? A: This may be possible; listen to the prompts for options related to recurring payments.

Tip: Keep a record of your transaction confirmation numbers.

In conclusion, navigating Wells Fargo's automated phone system effectively can streamline your banking experience. By understanding the system's prompts, options, and available services, you can manage your accounts efficiently and securely. While online and mobile banking offer alternative methods for account management, automated phone systems continue to provide a valuable resource, especially for those seeking 24/7 access or those who prefer verbal interaction. Taking the time to familiarize yourself with the system's features can empower you to take control of your finances and make the most of the convenience and accessibility it offers. While automated systems aim to simplify banking, remember that human assistance is always available if needed. Don't hesitate to contact a Wells Fargo representative if you encounter any difficulties or require personalized support. Utilizing both automated and human resources strategically can optimize your banking experience and ensure your financial needs are met effectively.

Maximize engine life delo oil 15w40 walmart guide

Show your colors the ultimate guide to georgia bulldogs profile pictures

Unlocking underwater worlds humminbird wide view fish finders