Send Money Online with Western Union: A Comprehensive Guide

In today's interconnected world, sending money across borders has become increasingly crucial. Whether supporting family abroad, paying international invoices, or managing overseas investments, the need for a reliable and efficient money transfer service is paramount. Western Union's online money transfer platform emerges as a prominent solution, offering a convenient way to send funds globally. This comprehensive guide delves into the intricacies of using Western Union to send money online, exploring its history, benefits, step-by-step instructions, best practices, and more.

Imagine needing to send funds to a loved one in a different country urgently. Traditionally, this would have involved a trip to a physical Western Union agent location. However, with the advent of online money transfers, this process has been streamlined, empowering users to send money from the comfort of their homes, anytime, anywhere. This digital transformation has revolutionized how we manage our finances, making cross-border transactions significantly easier and more accessible.

Western Union's history dates back to 1851, starting as a telegraph company. Over the years, it evolved into a global leader in financial services, pioneering the concept of money transfers. The development of their online platform represents a significant milestone, enabling faster and more convenient transactions than ever before. This legacy of innovation has positioned Western Union as a trusted name in the industry.

The ability to send money online via Western Union carries significant importance in our globalized world. It facilitates seamless cross-border transactions for various purposes, from personal remittances to business payments. This service empowers individuals and businesses to connect financially, fostering international commerce and personal relationships. The convenience and speed offered by online money transfers have made them an integral part of our interconnected world.

While Western Union's online money transfer service offers numerous advantages, understanding the potential issues is crucial for a smooth experience. These may include transaction fees, exchange rates, and security concerns. Being aware of these potential challenges allows users to make informed decisions and take necessary precautions to ensure safe and cost-effective transactions.

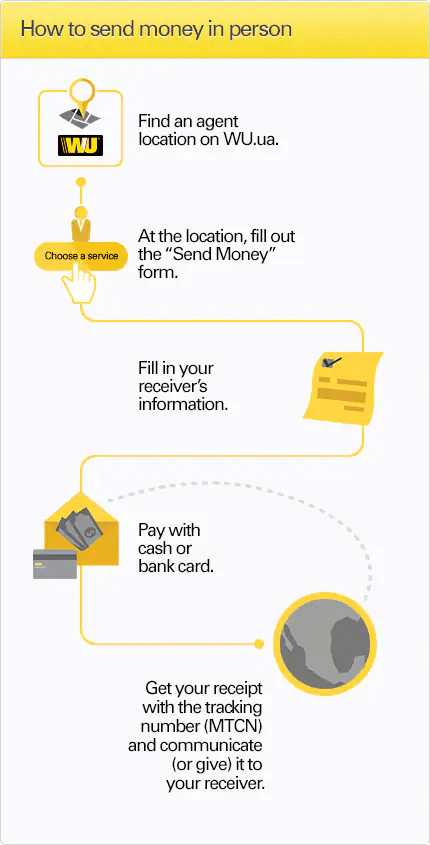

Transferring money online with Western Union involves creating an account, providing recipient details, selecting the amount and payment method, and confirming the transaction. The recipient can typically pick up the funds at a designated Western Union agent location or have the money deposited directly into their bank account, depending on the receiving country's options.

Benefits of using Western Union to send money online include speed, convenience, and a vast global network. Transactions are often processed quickly, allowing recipients to access funds within minutes or hours. The online platform is accessible 24/7, eliminating the need to visit physical locations during business hours. Western Union's extensive network covers over 200 countries and territories, ensuring reach across the globe.

Advantages and Disadvantages of Western Union Online Money Transfers

| Advantages | Disadvantages |

|---|---|

| Speed and convenience | Transaction fees can vary |

| Global reach | Exchange rate fluctuations |

| Multiple payment and receiving options | Potential security risks if precautions are not taken |

Best Practices

1. Verify recipient details: Double-check the accuracy of the recipient's name, location, and account information.

2. Compare exchange rates: Research current exchange rates to ensure you're getting a competitive deal.

3. Protect your account information: Use strong passwords and be cautious of phishing scams.

4. Track your transfer: Monitor the status of your transaction using the provided tracking number.

5. Keep transaction records: Save confirmation emails and receipts for future reference.

Frequently Asked Questions (FAQs)

1. How much does it cost to send money online with Western Union? Answer: Fees vary based on the amount, destination, and payment method.

2. How long does a Western Union online transfer take? Answer: Transfers can be completed within minutes or hours, depending on the destination and receiving method.

3. How can I track my Western Union transfer? Answer: Use the tracking number provided in your confirmation email.

4. What payment methods can I use for online transfers? Answer: Options often include debit cards, credit cards, and bank accounts.

5. What documents do I need to send money online? Answer: Generally, you'll need a valid government-issued ID.

6. How does the recipient receive the money? Answer: Funds can be picked up at a Western Union agent location or deposited into a bank account.

7. What if there's a problem with my transfer? Answer: Contact Western Union customer support for assistance.

8. Is it safe to send money online with Western Union? Answer: Western Union utilizes security measures to protect transactions, but users should also take precautions to safeguard their information.

In conclusion, Western Union offers a convenient and reliable way to send money online, connecting individuals and businesses across the globe. By understanding the process, benefits, and best practices, users can maximize the advantages of this service while mitigating potential challenges. The ability to transfer funds quickly and securely has become essential in our interconnected world. Western Union's online platform empowers users to manage their international financial transactions effectively, whether for personal or business purposes. Embracing this technology allows us to navigate the complexities of global finance with greater ease and confidence.

California senior dmv prep guide

The enduring legacy of marv levys playoff performances

Decoding bcbs deductibles your 150 question answered