Sending Money to India with Western Union: A Comprehensive Guide

In today's interconnected world, the need to send money across borders has become increasingly common. For those looking to remit funds to India, Western Union stands as a familiar option. But is it the right choice for you? This comprehensive guide delves into the nuances of using Western Union for money transfers to India, offering a detailed look at its process, advantages, potential drawbacks, and everything in between.

Sending money to loved ones in India, covering business expenses, or making investments requires a reliable and efficient transfer method. Western Union has long been a player in the remittance market, offering a seemingly straightforward way to move money internationally. However, understanding the intricacies of the system is crucial to making informed decisions and maximizing the value of your transfer.

Western Union's history spans over a century, starting with its origins in telegraphy. Its global network has made it a recognizable name in money transfers, allowing for cash pickups at numerous agent locations. This extensive reach is particularly important for remittances to India, where recipients might not always have access to traditional banking services. The service has evolved from its telegraphic roots to embrace digital platforms, providing more options for initiating and receiving transfers.

The significance of a service like Western Union for money transfers to India lies in its accessibility. For many, it provides a critical link to financial support from abroad. The ability to send money quickly, often within minutes, can be invaluable during emergencies or for time-sensitive payments. However, concerns often arise regarding the associated fees and exchange rates, which can significantly impact the final amount received by the beneficiary in India.

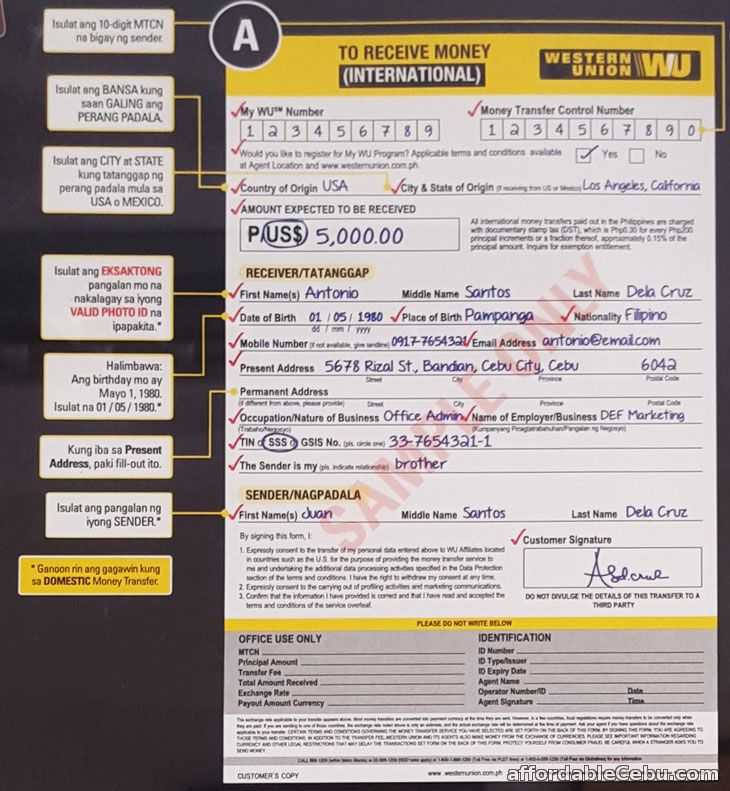

Using Western Union to transfer money to India involves several steps. Typically, you would start by visiting a Western Union agent location or using their website or app. You'll need to provide details about yourself, the recipient, the amount being sent, and the desired payout method (cash pickup or bank transfer). A Money Transfer Control Number (MTCN) is then generated, which the recipient will need to collect the funds.

Benefits of using Western Union include speed, global reach, and varied payout options. The vast network of agent locations in India facilitates easy cash pickup for recipients, even in remote areas. Speed is another advantage, with transfers often completed within minutes. Finally, the option to send money directly to bank accounts provides added convenience.

Example: Imagine a family in the US needing to send emergency funds to a relative in India for medical expenses. Western Union's speed and accessibility can be crucial in such situations, allowing the recipient to quickly access the necessary funds.

Action Plan for sending money via Western Union: 1. Gather recipient details (name, address, phone number). 2. Determine the amount and payout method. 3. Compare fees and exchange rates. 4. Visit a Western Union agent location or use their website/app to initiate the transfer. 5. Provide the MTCN to the recipient.

Advantages and Disadvantages of Using Western Union to Transfer Money to India

| Advantages | Disadvantages |

|---|---|

| Speed of transfer | Potentially higher fees compared to other services |

| Wide network of agent locations | Exchange rates might not be the most favorable |

| Multiple payout options (cash pickup, bank transfer) | Security concerns related to fraud and scams |

Best Practices: 1. Compare fees and exchange rates before initiating a transfer. 2. Verify recipient details carefully. 3. Keep the MTCN secure and share it only with the intended recipient. 4. Be aware of potential scams and avoid sharing personal information with unknown individuals. 5. Contact customer support if any issues arise.

FAQ:

1. How long does a Western Union transfer to India take? Typically, transfers are completed within minutes.

2. What are the fees for sending money to India via Western Union? Fees vary based on the transfer amount, payout method, and location.

3. How can I track my Western Union transfer? You can track your transfer online using the MTCN.

4. What documents do I need to send money via Western Union? You'll typically need a valid ID.

5. Can I send money to a mobile wallet in India using Western Union? This depends on the specific mobile wallet and availability.

6. What is the maximum amount I can send to India via Western Union? Limits vary based on regulations and your transfer history.

7. What should I do if I encounter problems with my Western Union transfer? Contact Western Union customer support for assistance.

8. How can I avoid Western Union scams? Be cautious of unsolicited requests for money and verify the identity of anyone asking for your personal information.

Tips and Tricks: Compare exchange rates and fees from different providers before choosing Western Union. Consider sending larger amounts less frequently to minimize the impact of fees. Use online platforms for potentially lower fees compared to agent locations.

In conclusion, Western Union offers a well-established method for sending money to India, offering speed and a widespread network of agent locations. However, potential drawbacks such as fees and exchange rates need careful consideration. By understanding the process, associated costs, and best practices, you can make informed decisions about whether Western Union is the right choice for your specific needs. Weighing the advantages and disadvantages against alternative transfer methods is crucial for maximizing the value of your remittance and ensuring its secure and timely delivery. While Western Union offers convenience, exploring other options and staying informed about the latest advancements in international money transfer services is always recommended. Ensure you are well-versed in the specifics of each transfer method to make the most financially sound decision for your needs.

Mastering ui element placement in unity transform position secrets

Unlocking the gs 7 step 2 salary mystery

Unmasking the allure exploring the academys undercover professor phenomenon