Smart Money Moves: Guide to Wells Fargo Youth Accounts

Are you looking for a way to teach your kids about financial responsibility? Opening a youth bank account can be a powerful tool. In this comprehensive guide, we’ll delve into Wells Fargo youth accounts, exploring the benefits, potential drawbacks, and practical steps to get started. This will equip you with the knowledge to make informed decisions about your child's financial future.

A bank account for kids isn't just about holding money; it's an educational platform. It provides hands-on experience with managing finances, from depositing allowances to tracking spending. With a Wells Fargo account tailored for young people, you can empower your child to develop crucial money management skills that will serve them well throughout their lives. This early exposure to banking can set the stage for responsible financial habits in adulthood.

Wells Fargo offers options for young savers and spenders. Understanding the specifics of each account type is key to making the right choice for your child’s needs. We'll explore the different youth account offerings from Wells Fargo to help you navigate the choices available. Whether it's a basic savings account or one with debit card access, understanding the options is essential.

One of the primary motivations for opening a Wells Fargo youth account is to instill financial literacy. By actively involving your child in managing their account, you can introduce concepts like budgeting, saving, and the importance of earning. These practical lessons can be far more effective than abstract discussions about money. Through the real-world application of banking, children can grasp the value of a dollar and the importance of saving for future goals.

Choosing the right youth bank account is a significant decision. This guide aims to provide you with the information you need to make a confident choice for your child. We'll cover everything from the account opening process to ongoing management tips. This guide aims to equip you with all the necessary information for your child's financial journey.

Wells Fargo has a long history of offering youth accounts, evolving them to meet the changing needs of families. These accounts aim to provide children with a safe and accessible way to manage their money. While specific historical details require further research directly with Wells Fargo, the focus has consistently been on youth financial education.

A youth account, often jointly owned with a parent or guardian, allows children to deposit money, track balances, and potentially make withdrawals. With a Wells Fargo youth account, parents can monitor transactions and guide their children's financial decisions. Some accounts offer debit cards for older children, providing supervised spending practice.

Benefits of a Wells Fargo kids account can include earning interest on savings, learning to track spending, and building a foundation for future credit history. For example, a child can deposit their birthday money and watch it grow with interest, learning the power of compounding. By tracking their debit card purchases, they gain awareness of their spending habits. And, consistent responsible account management can contribute to positive financial habits in the future.

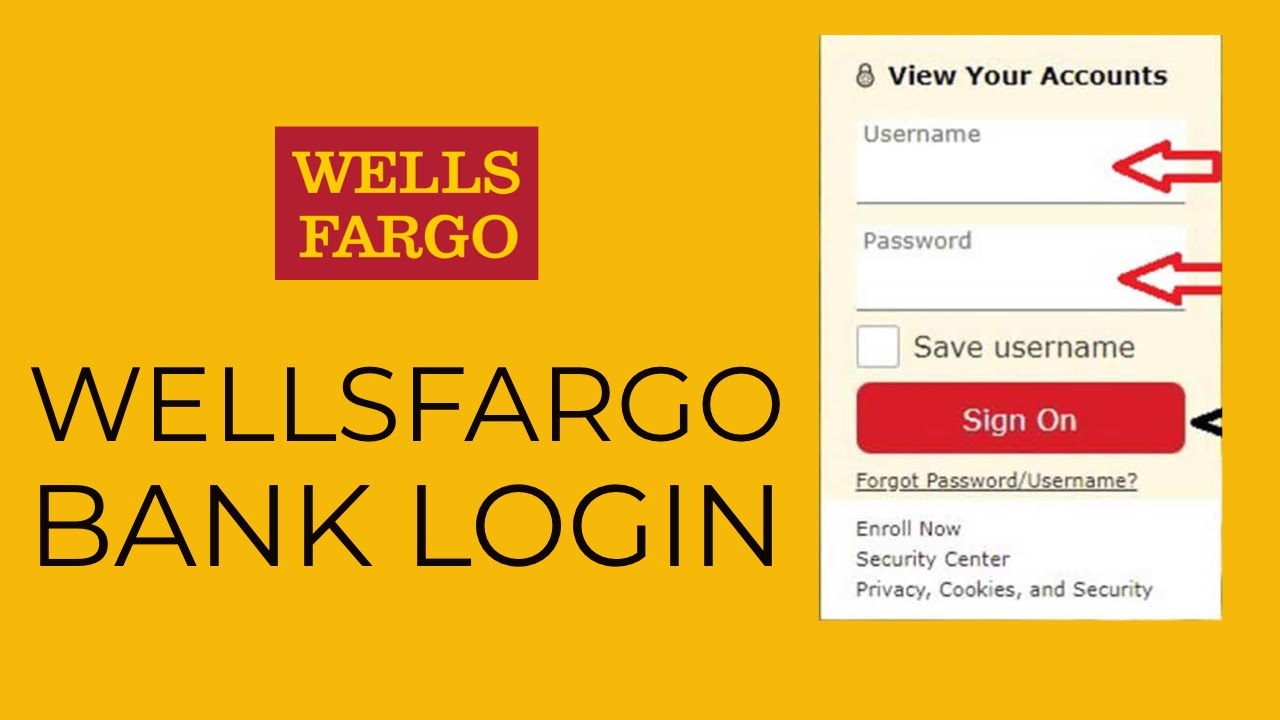

To open a Wells Fargo youth account, gather necessary documentation like your child's social security number and birth certificate. Visit a local branch or explore online application options. Discuss account features and responsibilities with a bank representative.

Advantages of a Wells Fargo Kids Account might include convenient online banking tools, parental controls, and educational resources. Disadvantages could include monthly fees if certain balance requirements aren't met, limited ATM access, or restrictions on certain transactions. Check with Wells Fargo for the most current fee and feature information.

Best practices include setting savings goals with your child, regularly reviewing account statements together, and discussing responsible spending habits. Use real-life scenarios to teach about budgeting and smart financial choices.

Frequently asked questions often cover topics like age requirements, account types, fees, and parental controls. Check the Wells Fargo website for their detailed FAQs.

Tips for maximizing a youth account include setting up automatic allowance deposits, encouraging regular saving, and discussing the importance of giving back to the community through charitable donations.

In conclusion, a Wells Fargo youth account can be a valuable tool for teaching your child about financial responsibility. By involving them in managing their money, you're equipping them with lifelong skills. From saving for future goals to understanding the consequences of spending choices, a youth bank account provides practical experience. While there may be some challenges, like managing account fees and ensuring appropriate usage, the benefits of early financial education outweigh the potential drawbacks. Empower your child today with the gift of financial literacy by exploring a Wells Fargo youth bank account and setting them on the path to a secure financial future. Take the first step and learn more about the offerings available to help your child thrive financially.

Navigating autism diagnosis in adulthood

Revitalize your bowling game homemade reactive ball cleaner

Navigating oklahoma roads a drivers license test companion