Unlocking Financial Clarity: Mastering Spreadsheets for Accounting

Are you ready to transform your accounting practices? In today's fast-paced business world, accurate and efficient financial management is paramount. A key tool that empowers businesses of all sizes to achieve this is the spreadsheet, or in Spanish, "hoja de calculo para contabilidad." This seemingly simple tool can revolutionize how you handle financial data, providing clarity, control, and actionable insights.

Spreadsheets, or "hojas de calculo," have become indispensable for accounting professionals. They offer a dynamic and adaptable platform for organizing, analyzing, and interpreting financial information. From basic bookkeeping to complex financial modeling, these tools are essential for effective financial management. This article delves into the world of spreadsheets for accounting, exploring their history, benefits, and best practices.

The origin of spreadsheets can be traced back to paper-based ledger systems. However, the digital revolution brought forth the electronic spreadsheet, transforming accounting practices forever. VisiCalc, launched in 1979, is widely considered the first electronic spreadsheet program, paving the way for modern applications like Microsoft Excel and Google Sheets. These software solutions have become ubiquitous in accounting, offering powerful functionalities for calculations, data visualization, and reporting.

The importance of "hojas de calculo para contabilidad" cannot be overstated. They provide a structured approach to financial record-keeping, enabling businesses to track income, expenses, assets, and liabilities with precision. Furthermore, spreadsheets facilitate data analysis, allowing businesses to identify trends, forecast future performance, and make informed decisions. They are essential for budgeting, financial reporting, and regulatory compliance.

However, there are also challenges associated with using spreadsheets for accounting. One key issue is the potential for human error. Manual data entry and complex formulas can lead to inaccuracies if not carefully managed. Data security is another concern, especially when dealing with sensitive financial information. Implementing proper security measures and access controls is crucial to protect against data breaches.

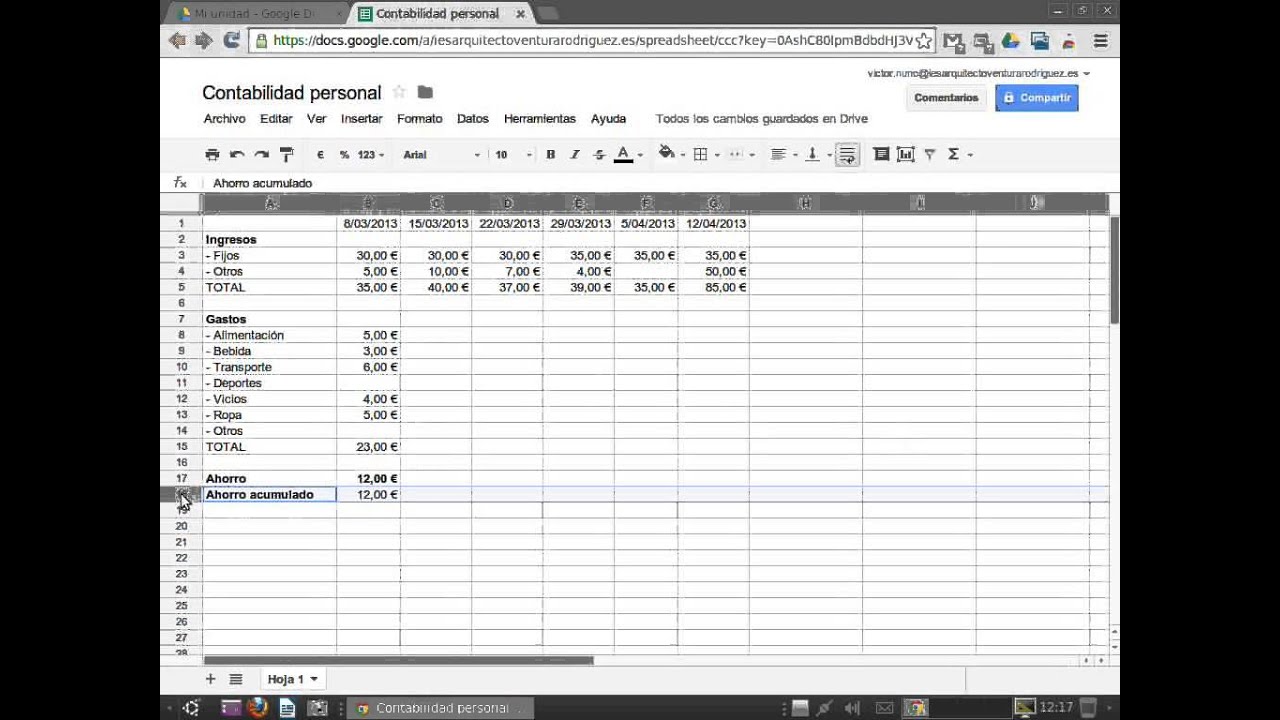

A simple example of using a "hoja de calculo para contabilidad" is creating a budget. You can list your income sources in one column and your expenses in another. Formulas can then be used to calculate your net income and track your spending against your budget targets.

One benefit of using "hojas de calculo" is their flexibility. You can customize them to suit your specific needs and create various reports. Another advantage is their accessibility; many free and affordable options are available. Lastly, they offer powerful data analysis capabilities, allowing you to gain deeper insights into your finances.

To successfully implement spreadsheets in your accounting processes, ensure your team has proper training. Start with basic functionalities and gradually introduce more advanced features. Regularly back up your data to prevent loss and maintain data integrity. Employ data validation techniques to minimize errors and ensure accurate information.

Advantages and Disadvantages of Spreadsheets for Accounting

| Advantages | Disadvantages |

|---|---|

| Flexibility | Potential for Errors |

| Accessibility | Security Risks |

| Data Analysis Capabilities | Limited Collaboration |

Best Practices: 1. Use data validation. 2. Implement version control. 3. Protect sensitive information. 4. Document your formulas. 5. Regularly back up your data.

Real Examples: 1. Budgeting. 2. Expense tracking. 3. Financial reporting. 4. Invoice management. 5. Inventory tracking.

Challenges and Solutions: 1. Data errors - Implement data validation. 2. Data security - Use strong passwords and access controls. 3. Formula complexity - Use clear and concise formulas. 4. Collaboration issues - Consider cloud-based solutions. 5. Scalability - Explore more robust accounting software for large datasets.

FAQs: 1. What is a spreadsheet? 2. What are the benefits of using spreadsheets for accounting? 3. What are the challenges of using spreadsheets for accounting? 4. How can I improve my spreadsheet skills? 5. What are some best practices for using spreadsheets in accounting? 6. Are there any free spreadsheet programs available? 7. How can I protect my spreadsheet data? 8. What are some common formulas used in accounting spreadsheets?

Tips and Tricks: Utilize keyboard shortcuts. Learn advanced formulas. Explore built-in functions. Use conditional formatting for better visualization. Create charts and graphs to analyze data effectively.

In conclusion, "hoja de calculo para contabilidad," or spreadsheets for accounting, are essential tools for modern financial management. From tracking expenses to generating complex financial reports, these tools empower businesses to gain control of their finances. While there are potential challenges, implementing best practices and utilizing available resources can mitigate risks and maximize the benefits of these powerful tools. Embracing spreadsheets in your accounting workflows can lead to improved accuracy, enhanced efficiency, and data-driven decision-making, paving the way for financial success. Take the time to master these tools, explore their capabilities, and unlock their full potential for your business. Start leveraging the power of spreadsheets today and transform your accounting processes for a brighter financial future.

Unlocking affordable prescriptions your guide to optum rx drug plan premiums

Unlocking the potential of your ea fc 24 ps5 experience

Black clover anime status update