Unlocking Ocean County NJ Property Secrets: Deed & Mortgage Search Guide

Embarking on a real estate journey in Ocean County, New Jersey? Understanding the intricacies of property ownership is paramount. This involves delving into the world of Ocean County deed and mortgage records. Whether you're a seasoned investor, a first-time homebuyer, or simply curious about a property's history, accessing these crucial documents is essential.

Accessing property information in Ocean County involves navigating the local recording system. This system maintains a comprehensive database of deeds, mortgages, and other related documents. A thorough Ocean County property records search can unveil a wealth of information, including ownership history, liens, easements, and more. This data is invaluable for making informed decisions regarding real estate transactions.

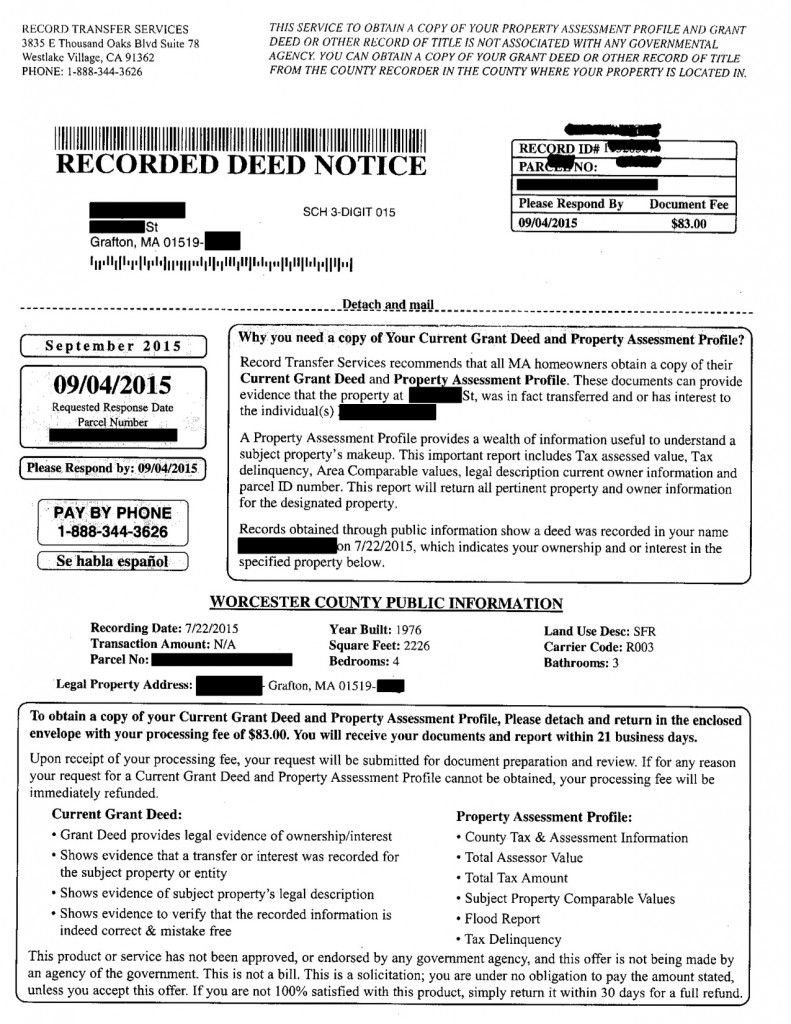

The process of conducting an Ocean County deed and mortgage search can seem daunting, but with the right guidance, it becomes manageable. Online platforms, the County Clerk's office, and title companies offer various avenues for accessing these records. Understanding the nuances of each method can streamline the search process and provide the necessary information efficiently.

The importance of conducting a thorough Ocean County NJ deed and mortgage search cannot be overstated. It's a crucial step in due diligence for any real estate transaction. This process helps identify potential issues that could affect ownership, such as outstanding liens or unresolved legal disputes. A clear understanding of a property's history protects buyers and investors from unforeseen complications.

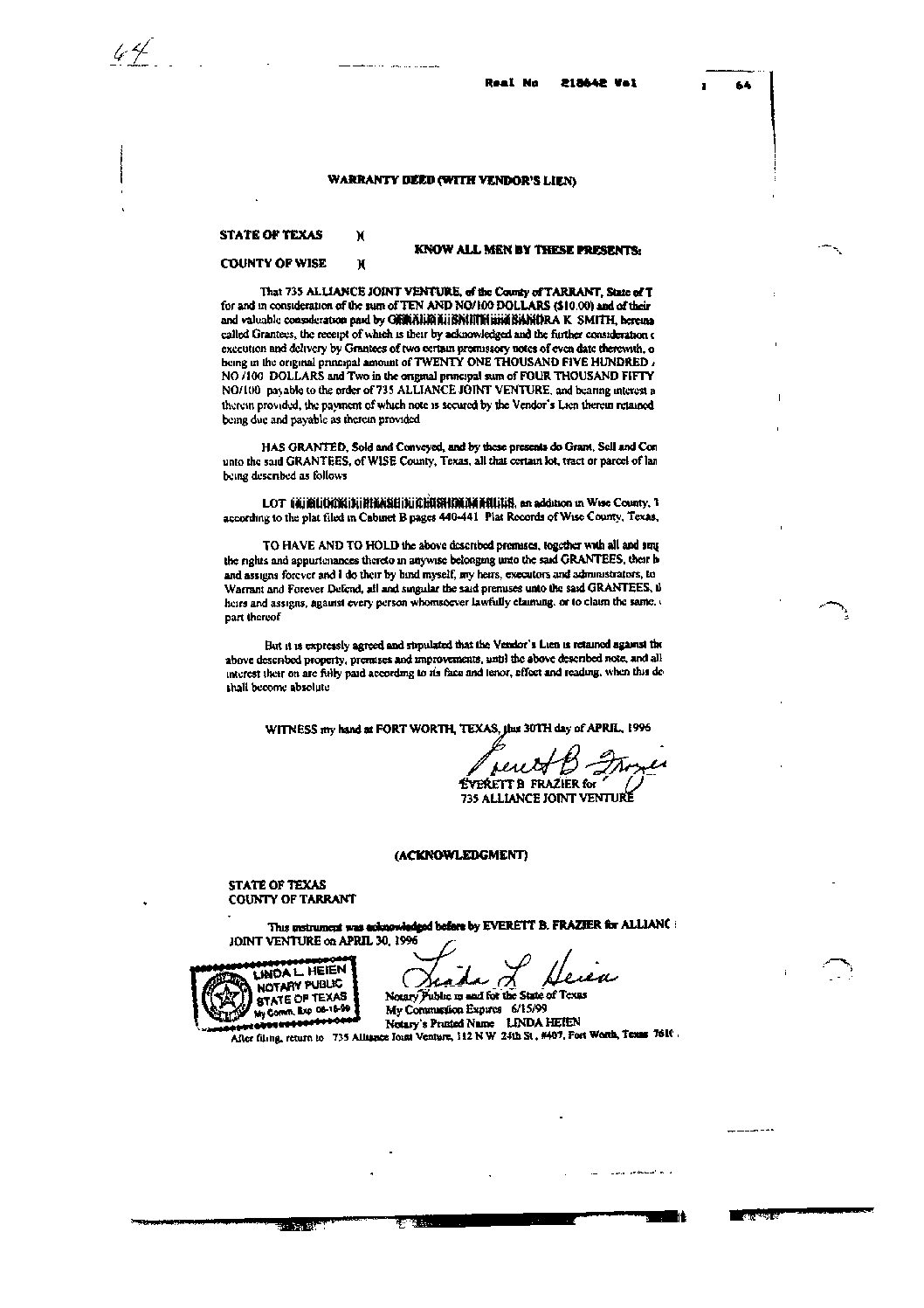

Navigating the Ocean County deed and mortgage landscape involves understanding key terminology. A deed is the legal document that transfers ownership of a property. A mortgage, on the other hand, is a loan secured by real estate. A title search examines public records to ensure clear ownership and identify any encumbrances on the property. These concepts are foundational to comprehending the information revealed in a property records search.

Historically, accessing these records involved visiting the Ocean County Clerk's office in person. However, with advancements in technology, online platforms have emerged, offering convenient access to digitized records. This has simplified the search process and made information more readily available to the public.

One significant issue related to Ocean County deed and mortgage searches is ensuring the accuracy and completeness of the information. Data entry errors or incomplete records can lead to discrepancies. Therefore, verifying information from multiple sources is crucial for a comprehensive understanding.

Benefits of conducting a thorough Ocean County deed and mortgage search include: 1) Identifying potential title defects, 2) Verifying ownership history, 3) Discovering any existing liens or encumbrances. For instance, a search might reveal an unpaid property tax lien that could affect the buyer's ownership.

Advantages and Disadvantages of Online vs. In-Person Searches

| Feature | Online Search | In-Person Search |

|---|---|---|

| Convenience | High | Low |

| Cost | Potentially Lower | Potentially Higher (travel, time) |

| Access to Staff Assistance | Limited | Direct Access |

Best practices include: 1) Utilizing reputable online platforms, 2) Verifying information with the County Clerk, 3) Consulting with a title company, 4) Documenting all findings, 5) Seeking legal advice when necessary.

Frequently Asked Questions: 1) Where can I conduct an Ocean County deed search? 2) What information is included in a mortgage record? 3) How much does a title search cost? 4) How far back do property records go? 5) What is a lien? 6) How do I resolve a title issue? 7) Can I access records online? 8) What if I find discrepancies in the records?

Tips for efficient searching include using specific keywords, understanding the indexing system, and seeking professional assistance when needed.

In conclusion, conducting a thorough Ocean County deed and mortgage search is a critical step in any real estate transaction. Understanding property history, ownership, and any existing encumbrances protects buyers and investors from potential complications. By utilizing available resources, following best practices, and seeking expert advice when necessary, individuals can navigate the process effectively. This proactive approach empowers informed decision-making and ensures a secure and successful real estate experience in Ocean County, New Jersey. Take the time to invest in your peace of mind and protect your investment by conducting a thorough search. It is a crucial step that can save you from future headaches and financial burdens. Don't hesitate to seek help from professionals if you are unsure about any aspect of the process. Your due diligence will contribute significantly to a smooth and successful real estate journey.

Understanding condenser vacuum pump operations

Unlocking sc medicare advantage plans eligibility

Collingwood color magic benjamin moore paint pairings